In the past few weeks, China has signed nuclear deals with Argentina, Romania, South Africa and Ukraine, as well as finalising its participation with EDF Energy in the construction of the UK's Hinkley Point C nuclear plant.

In the past few weeks, China has signed nuclear deals with Argentina, Romania, South Africa and Ukraine, as well as finalising its participation with EDF Energy in the construction of the UK’s Hinkley Point C nuclear plant.

On 15 November, China concluded a $15bn deal with Argentina for the construction of two nuclear units, which will add 1750MWe to the energy already produced by Argentina’s three operating power reactors (two at Atucha and one at Embalse). Under the deal, signed on the sidelines of the G20 summit in the Turkish coastal resort of Antalya, China will contribute 85% of the required financing, according to a statement issued by the Argentine president’s office. In July 2014, China and Argentina signed a high-level agreement paving the way for construction of a third pressurised heavy water reactor (PHWR) at the Atucha.

China National Nuclear corporation (CNNC) undertook to work with Argentina’s state-owned nuclear operator, Nucleoelectrica Argentina Sociedad Anónima (NASA), on the fourth reactor, Atucha 3, which is expected to cost about $6bn. NASA and CNNC are to form a consortium for construction of the plant with over 70% of the plant components to be supplied by Argentine companies. CNNC is now expected to advance the negotiations with Chinese financial institutions to conclude project financing. Other Chinese companies involved in the Argentinean nuclear projects may include Harbin Electric, Shanghai Electric, Zhefu Holding Group and China First Heavy Industries Group.

Atucha 3 will use a Canadian-developed Candu PHWR, while the fifth reactor, Atucha 4, which is estimated to cost $7bn, is expected to use Hualong One, China’s third-generation pressurised-water reactor. Hualong One was jointly developed by China’s two main nuclear companies – CNNC and China General Nuclear Power Group (CGN) with the aim of exporting the reactor and to apply for regulatory approval in potential export markets.

"China’s nuclear technology can be as competitive as the ones offered by its Western counterparts," said Ma Yi, an expert from China Nuclear Power Engineering Co, referring to Hualong One which is already under construction at China’s Fuqing plant in Fujian province.

Looking to South Africa

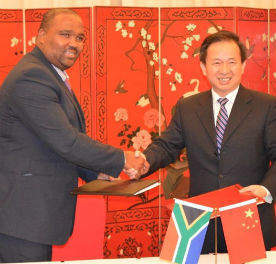

Chinese and South African nuclear regulators on 16 November signed a technical cooperation agreement which includes "licensing procedures, vendor inspections, inspector training and joint inspections and technical support," South Africa’s National Nuclear Regulator (NNR) announced.

China plans to compete with Russia, France, the USA and South Korea for a role in South African new-build construction programme, which is worth up to $50bn.

"Bilateral cooperation arrangements such as these serve as a valuable mechanism for ensuring that the NNR’s regulatory practices are… benchmarked against the best current standards and practices as applied internationally within the nuclear industry," NNR’s chief executive officer Bismark Tyobeka said in a statement. This follows a nuclear energy cooperation agreement signed a year ago, which South Africa said was in preparation for the possible use of Chinese nuclear technology.

Romanian deal

Earlier in November, CGN and Romanian national nuclear company Nuclearelectrica signed a memorandum of understanding on the development, construction, operation and eventual decommissioning of two new units (3&4) at the Cernavoda nuclear plant. Ownership of the project is divided among the Romanian energy ministry (82.48%), Romanian investment fund Fondul Proprietatea (9.10%) and ‘other investors’ (8.42%). In October the agreement was given final approval at an extraordinary general shareholders meeting. The Romanian government approved the deal in September.

Under the new arrangement, Nuclearelectrica will contribute €2m ($2.2m) for 49% of the joint-stock company (JVCo) that will build the new units and CGN will have 51%. Nuclearelectrica’s share will not fall below 30%. The project for the two new reactors was valued at €6.45bn s last October, but the feasibility study is to be revised.

Possibilities in Ukraine

China has also been talking with Ukraine about the possible construction of units 3&4 at Khmelnitsky nuclear power plant, but it seems to have been outmanoeuvred by Czech company Skoda JS for that project.

However, China Nuclear Energy Industry Corporation (CNEIC) is looking to participate in the development of Ukraine’s Novokonstantinovskoye uranium project, according to Ukraine’s Eastern Mining and Processing Combine (VostGOK).

Chinese specialists recently visited Novokonstantinovskoye mine and the hydrometallurgical plant in Zholtye Vody. VostGOK director generalAlexander Sorokin said the company was interested in all types of the cooperation. "We may consider other areas of cooperation, including organisation of U3O8 deliveries to China," Sorokin said.

Chinese agree on Hinkley

Finally, in late October, EDF and CGN signed a strategic investment agreement to build three new nuclear plants in the UK as old reactors reach the end of their design life. EDF will have a 66.5% stake in the 3200MWe Hinkley Point C project in southwest England, scheduled to start up in 2025, with CGN taking 33.5%. CGN will provide GBP6bn ($9.3bn) of the GBP18bn cost, Vincent de Rivaz, CEO of EDF Energy (UK), told reporters. EDF will consider adding new partners for a 15% stake in the project, but intends to retain more than 50%. CGN will make its investment in the UK through its new company called General Nuclear International (GNI).

Anticipating China’s involvement in UK nuclear development, design and engineering consultant Atkins is in discussion with Chinese contractors to collaborate on future UK nuclear new-build projects. Atkins UK and Europe CEO Nick Roberts told Construction News the firm had "established relationships with a number of progressive Chinese outbound contractors" to work with in the UK. Last year, Atkins signed a memorandum of understanding with CNNC, in a move aimed at supporting China’s entry into the UK new-build market.